The Changing Landscape of Insuring for Diversification

The agricultural landscape is evolving, and at Farm and General, we understand the challenges and opportunities this presents. As a forward-thinking farmer, you're probably eyeing new opportunities to diversify your income and future-proof your farm. Diversification can open new opportunities and protect your bottom line, but it also introduces new risks. That's where insuring for diversification comes in.

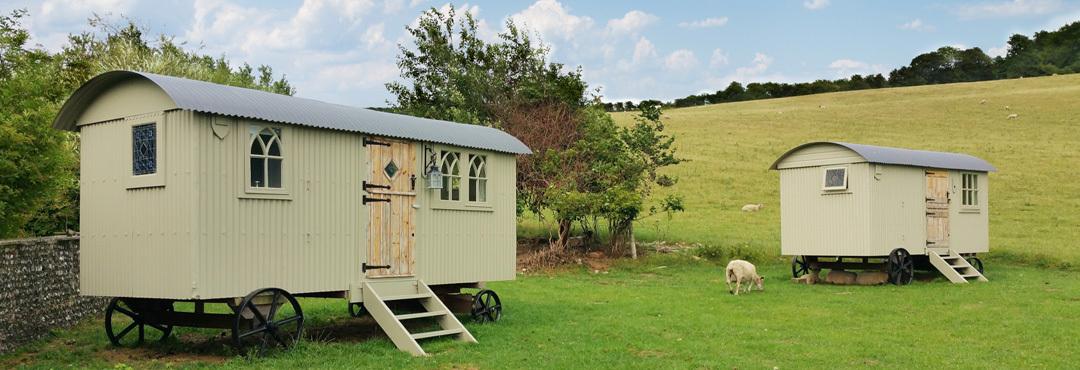

Diversification isn't just about spreading risk; it's about unlocking your farm's full potential. Imagine turning your fields into a thriving agritourism destination, harnessing the sun's power with solar panels, or delighting customers with your farm shop. These ventures can boost your income, enhance your brand, and create a sustainable legacy.

Ensuring you insure for diversification projects is an essential support for protecting your farm's financial future. It can help you cover unexpected costs and losses associated with your new ventures. As you expand your operations, your insurance needs will change. It's essential to have a policy that can adapt to your evolving business.

A Buzz at the LLT Show 2024

At the recent Land Leisure and Tourism Show, we had the privilege of engaging with numerous farmers and landowners. It was clear that diversification is top of mind for many. While there was a lot of enthusiasm for new ventures, we were surprised to find that insurance wasn't a primary consideration for many.

We asked attendees a series of questions, including whether they were currently considering diversification. Unsurprisingly, every single person raised their hand. However, when we inquired about their insurance plans, the response was less enthusiastic. This highlights a crucial gap: while diversification is a popular strategy, adequate insurance coverage is often overlooked.

Key Takeaways from the LLT Show

- Diversification is a hot topic: Farmers and landowners are actively seeking new ways to diversify their income streams.

- Insurance is often overlooked: While the need for insurance is acknowledged, it's not always prioritised.

- Education is key: Many attendees were unaware of the specific insurance needs associated with different diversification ventures.

Top Diversification Trends for 2025

As the agricultural landscape evolves, farmers are seeking innovative ways to bolster their income and ensure the long-term sustainability of their businesses. Diversification offers a promising path forward, but it's essential to navigate the opportunities and risks wisely. Here are some of the top diversification trends for 2025.

- Agritourism: Transform your farm into a haven for city dwellers seeking a taste of rural life. From farm stays to farm-to-fork dining, the possibilities are endless. By offering unique experiences like farm tours, workshops, and seasonal events, you can attract visitors and generate additional revenue. However, it's crucial to prioritise safety and liability. Public liability insurance is a must to protect yourself from accidents and lawsuits.

- Renewable Energy: Harness the power of the sun or wind to generate clean energy and extra income. By installing solar panels or wind turbines, you can reduce your energy costs and contribute to a sustainable future. However, consider investing in specialised insurance to cover equipment damage, power fluctuations, and grid connection issues.

- Farm Shops and Direct Sales: Sell your farm-fresh produce directly to customers through farm shops, farmers' markets, or online platforms. This can help you build a loyal customer base and command premium prices for your products. However, it's essential to comply with food safety regulations and consider product liability insurance to protect yourself from potential claims.

- Diversified Crop Production: Reduce your reliance on single commodities by growing a variety of crops. This can help you spread risk and adapt to changing market conditions. However, be prepared for market fluctuations, pests, diseases, and unpredictable weather. Crop insurance can provide a safety net to protect your investment.

- Value-Added Products: Transform your raw agricultural products into high-value products like jams or artisanal cheeses. This can increase your profit margins and attract a wider range of customers. However, it's important to comply with food labelling regulations and consider product liability insurance.

By diversifying your farm operations, you can create a more resilient and profitable business. However, it's essential to carefully assess the risks and take appropriate steps to protect yourself. Consult with an insurance broker to ensure you have adequate coverage and policy for your specific needs.

Protecting Your Future

To navigate the changing landscape of diversification, it's essential to work closely with an experienced insurance broker. At Farm and General, we're passionate about supporting farmers on their diversification journey. We offer comprehensive diversification insurance solutions and can help you assess risks, identify your specific needs, and find the right coverage.

Contact Farm and General today for a free consultation and discuss how our range of insurance policies can help you thrive in the changing agricultural landscape.

So, what are you waiting for? Embrace the future of farming. Diversify, innovate, and insure today.